According to RE/MAX’s 2024 Cottage Trends Report, Canadian RE/MAX brokers and agents are expecting to see an increase of 6.8% in recreational property prices.

The report shows that many cottage owners are choosing to hold their cottage properties, even with rising interest rates and affordability concerns. RE/MAX brokers and agents say not only has a flood of listings not hit the market this spring, but that it is unlikely to happen this year at all.

“Years of research* show that Canadians consistently see value in real estate ownership – both as a necessity and an investment. Those who have already gained a foothold in the recreational property market are determined to hold on to this asset, despite mounting affordability concerns across the country." -Christopher Alexander, President, RE/MAX Canada

Experts are forecasting the number of sales this year is expected to rise in 61.9% of regions analyzed, with increases ranging from 3% to upwards of 50%.

Recreational Property Demographics

Perhaps one of the most interesting shifts is the demographic now purchasing recreational properties, with young couples and families now responsible for 59% of the activity in the recreational housing market. This is a stark contrast to the 2018 analysis, where 91% of recreational property buyers were made up of retirees. Experts speculate the increase of hybrid and remote work play a part in this shift.

Around 38% of Canadian recreational property owners are spending more time at these properties post pandemic. The rate is especially high around younger generations; 55% among Gen Z (ages 18-24) and Millennials (25-39). Again, this is likely in part due to the flexibility of remote work.

The report also highlights what Canadians look for when buying recreational properties, with 46% prioritizing affordability, followed by proximity to water at 35%, and necessary amenities at 27%.

Regional Market Insights

Ontario

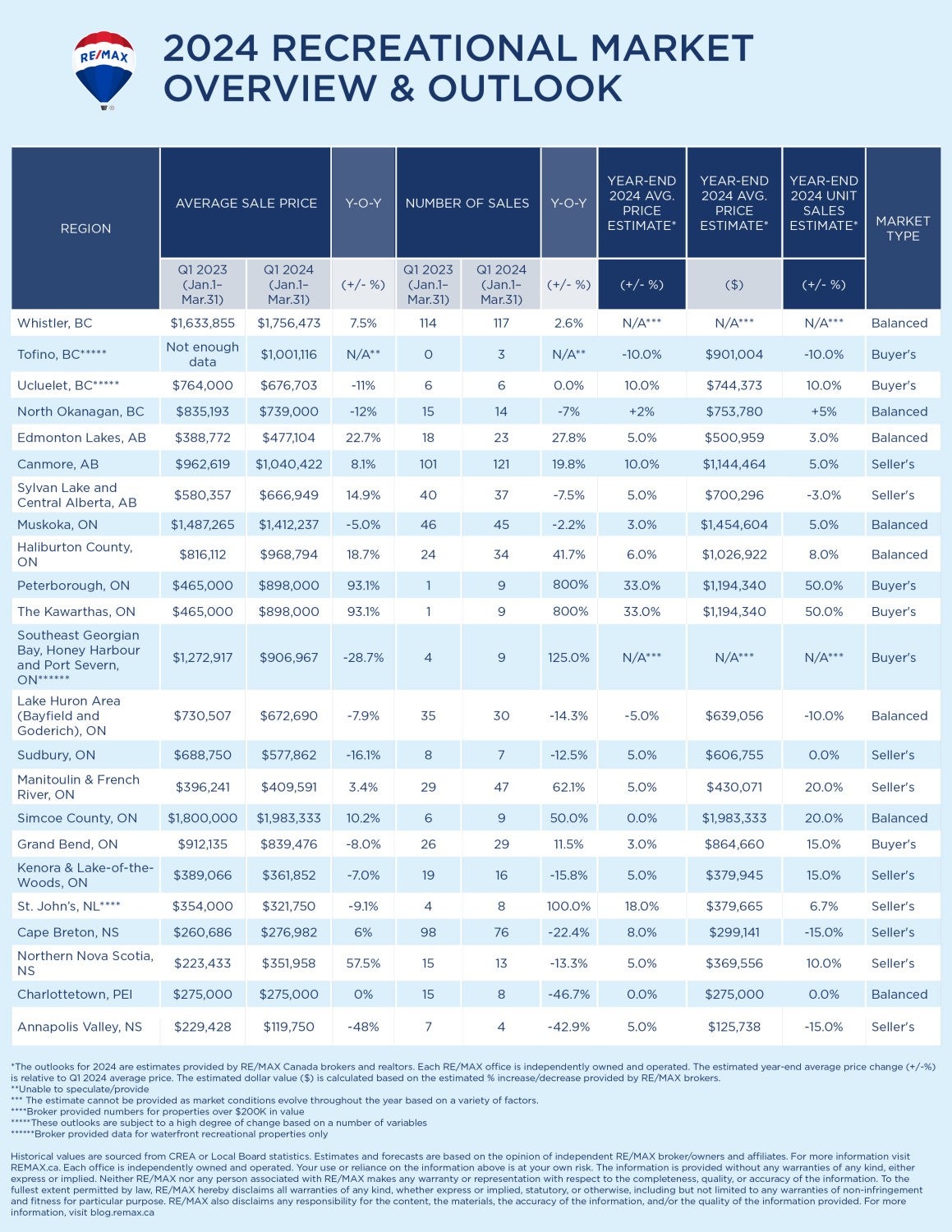

Ontario’s intra-provincial migration activity increased, whereas inter-provincial activity increased in regions in Western and Atlantic Canada by 54.5%. Year-over-year, 54% of Ontario’s recreational property markets observed declines in average prices ranging from 5% to 28.7%. These declines were noted in regions such as Muskoka (-5%); Subury (-16.1%); and Honey Harbour and Port Severn (-28.7%).

Meanwhile, certain markets saw an increase in prices. Namely, Haliburton County (+18.7%) and Peterborough and The Kawarthas (+93.1%). RE/MAX brokers and agents anticipate that cottage prices will increase up to 33% in 72% of recreational markets by the end of this year. However, Simcoe County is expected to be an exception, as the interest rate climate may keep prices level.

Western Canada

Year-over-year, 83% of regions across Western Canada witnessed a rise in average recreational sale prices. This increase was notable in Whistler (+7.5%); Tofino (+100%, attributed to the absence of available inventory); and Edmonton Lakes (+11.8%). Conversely, Ucluelet saw a decline in sales price (-11%).

RE/MAX brokers and agents believe Western Canadian regions might expect average price hikes ranging between 5 and 10% this year, fueled by ongoing demand growth. Recreational property owners are retaining their properties rather than selling due to affordability concerns.

Atlantic Canada

Consistent year-over-year price upticks have been observed in Northern Nova Scotia (+57.5%) and Cape Breton (+6.3%). Conversely, decreases in average price were witnessed in Annapolis Valley (-47.8%) and St. John’s (-9.1%).

Looking ahead to the forthcoming summer and winter seasons, demand from families, couples, and retirees, combined with limited inventory, is anticipated to continue influencing home sales and prices. By year-end, the average price of recreational properties in Atlantic Canada is forecasted to rise in St. John’s (+18%), Cape Breton (+8%), Northern Nova Scotia, and Annapolis Valley (+5%). Prices in Charlottetown are likely to remain stable, averaging $275,000.

Take a look at the data table for a more precise breakdown:

*According to a Leger survey commissioned by RE/MAX Canada for its annual Housing Market Outlook Report in 2023 and 2024, 73 per cent of Canadians agreed that home ownership is the best long-term investment. In 2021, 52 per cent of Canadians agreed, while in 2022, 49 per cent shared the same sentiment.